Crypto at a Pivotal Moment

The U.S. election combined with an easier monetary environment could spark the next crypto bull market

This piece was originally published on Coindesk

Seismic events often trigger cryptoasset market cycle transitions. The 2016-2017 cycle was largely industry-driven, expanding crypto's reach beyond early adopters. In contrast, the 2020-2021 surge was propelled by unprecedented post-COVID interest rate cuts.

Now, two powerful catalysts converge: the looming 2024 U.S. elections and a nascent global liquidity cycle for risk assets. This potent combination could shatter bitcoin's $58,000 to $70,000 trading range, where it has largely remained since late March, potentially igniting the next major market movement.

2024 U.S. elections likely to gain importance as election day nears

This election cycle marks several firsts for crypto, primarily how the industry emerged as a relevant topic in political discourse and campaign financing. Another interesting trend is how Polymarket, a breakthrough crypto application, now provides real-time estimates of consensus on election results, with over $1 billion at stake.

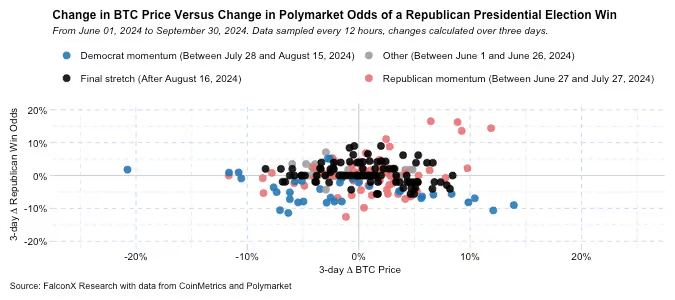

The chart below shows the relationship between two factors over 3-day periods: changes in Republican win odds on Polymarket and changes in bitcoin prices as a proxy for overall crypto market performance. Different election phases are color-coded: gray for the initial phase (before June 26), red for the period of Republican momentum (between the end of June and the end of July), blue for Democratic gains (between the end of July and mid-August), and black for the final stretch (since mid-August).

If the market linked crypto prices directly to Republican win odds, the dots in the chart above would form an upward-sloping 45-degree line. Conversely, a direct link to Democratic win odds would show a similar, but downward-sloping, line. Instead, we see a scattered cloud of dots, indicating no clear, consistent trend between election outcomes and crypto prices so far.

This dynamic is evident across all phases highlighted in different colors throughout the scatterplot. Although the relationship is stronger during the phase of Republican momentum, it still explains less than 20% of bitcoin price movements.

This doesn't mean the elections are unimportant for crypto price action. It is possible, if not likely, that this relationship strengthens as we approach Election Day, now less than one month away. But this inconsistent relationship suggests that other critical factors have also been dominating crypto market price action.

Interest rate outlook hints at novel regime for crypto prices

Recent global liquidity shifts have driven markets worldwide, including crypto. The Federal Reserve's strong start to this rate-cut cycle, coupled with China's surprising market-lifting measures, likely fueled crypto's recent price surge.

Unlike equities, crypto lacks extensive historical data for gauging returns across different interest rate regimes.

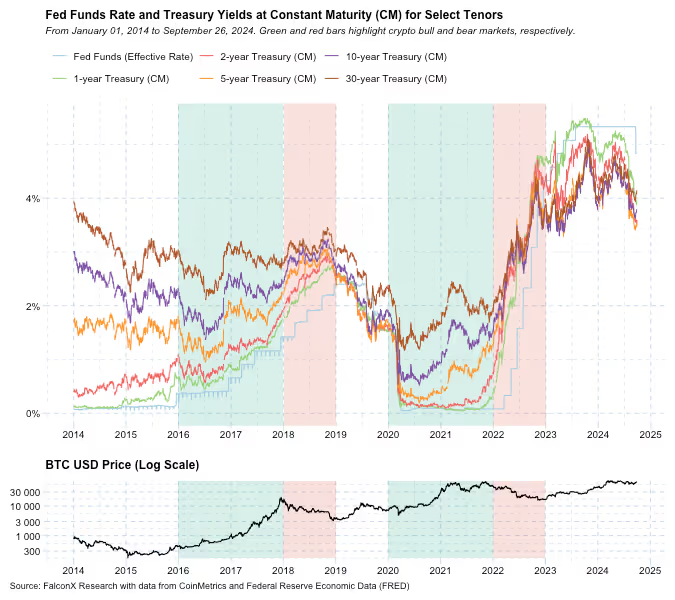

Nevertheless, examining crypto prices against rate environments remains instructive. The chart below shows the effective federal funds rate alongside Treasury constant-maturity yields from 1-year to 30-year tenors. For context, the lower chart displays bitcoin's USD price (in log scale for perspective), with color-coded market cycles: green for the 2016-2017 and 2020-2021 bull markets, red for the 2018 and 2022 bear markets.

This chart suggests that a soft landing with lower rates — the current investor consensus — would create an unprecedented macro backdrop for crypto. This scenario differs from both the industry-driven 2016-2017 cycle and the post-COVID, rate-cut-fueled 2020-2021 surge.

Consequently, macroeconomic factors are expected to significantly influence crypto prices in the near term, as evidenced by strengthening correlations between crypto and broader risk assets.

Looking ahead

Low crypto liquidity following Labor Day weekend indicates a market in wait-and-see mode. Institutional crypto discussions consistently focus on these two key themes. I’m optimistic that these two topics will resolve in a positive way for the industry and a new bull market could ensue in 2025.

While a wide range of outcomes remains possible, it’s clear that the next one to three months could set the tone for how the crypto market will look in 2025.

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.