Dissecting Key Market Trends Underpinning ETH’s Outperformance

The ETH recent outperformance is coming on the back of strong volumes and potentially attracting more institutional flow. Adding to this the increasing chatter around a spot ETH ETF approval, the H1 ETH–related conference circuit that starts next week with ETH Denver, and potential new narratives as restaking quickly emerging, the outlook for ETH in 2024 is looking increasingly bright.

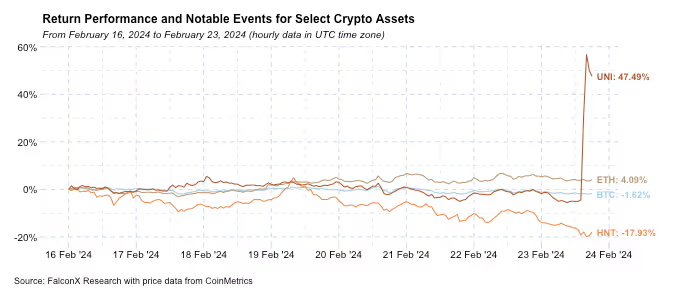

The crypto market had a quieter week than weeks prior, with few assets moving more than 10%. The total crypto market capitalization was up 5.29% (or 5.63% excluding stablecoins) and currently stands at $1.9 trillion (or $1.8 trillion excluding stablecoins), mostly led by ETH and alts.

Among the larger names, the two outliers were UNI, which skyrocketed over 40% after a proposal from the Uniswap Foundation to activate the fee that allows token holders to capture some of the protocol revenue, and HNT, which was down 18% as it corrects from a stellar recent performance.

Among the majors, ETH continues to outperform BTC.

Some attribute this outperformance to the potential approval of an ETH spot ETF. The key date to watch for this is May 23, the deadline for the SEC to respond to the earliest 19b-4 applicant. Others, myself included, believe that the recent outperformance is more related to the upcoming Dencun upgrade.

As we highlighted earlier this month, technical developments in crypto usually don’t impact price action meaningfully, at least in the short term. Ethereum upgrades, however, tend to be an exception.

The following chart shows the cumulative relative performance of ETH versus BTC in the 30 days before and after the past three major upgrades: Shapella, which introduced the ability to withdraw staked ETH on April 12, 2023, The Merge, which moved Ethereum from proof of work to proof of stake on September 15, 2023, and London, which changed the economic logic of ETH through the introduction of EIP-1559 on August 05, 2021.

This outperformance is coming on the back of strong volume. ETH spot daily trade volumes are now hovering above $5 billion. The last time ETH this volume level was achieved on a sustained basis was before the FTX fallout. For context, the ETH/BTC price ratio, now at 0.058, used to be above 0.075 during this period.

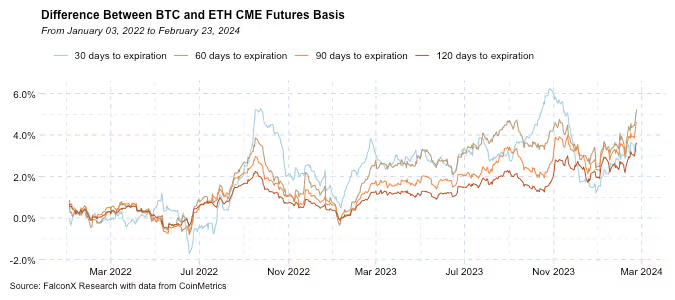

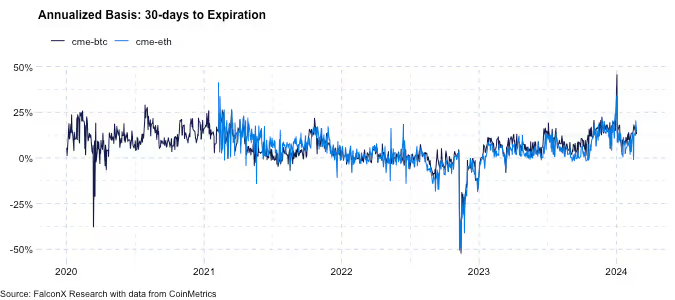

There is also some indication that institutional flow could be been gravitating towards ETH. Evidence of this comes from the CME basis differential between BTC and ETH has been shrinking significantly over the past few weeks for the most liquid part of the maturity curve.

The chart below shows this differential over time for maturities between 30 and 120 days (on a constant maturity basis, smoothed by a 10-day moving average).

There are two key trends in the chart above. First, the difference between the BTC and ETH CME basis has gradually but steadily been converging to the ETH staking yield recently, which is something we’ve already highlighted in the past. Second, this trend recently broke down for the short end of the curve. Note how the blue line above, which tends to be consistently the highest, is now among the lowest.

Part of this can be explained by the BTC CME basis shrinking at the beginning of 2024 as an immediate aftermath of the spot BTC ETF launches. Over the past few weeks, however, the BTC basis has been rising significantly to double-digit territory, but the ETH basis has been rising even more.

One way to explain this dynamic is that there can be some rotation occurring from BTC into ETH in the CME futures market, which is a market dominated by institutional investors.

Adding to this the increasing chatter around a spot ETH ETF approval, the H1 ETH–related conference circuit that starts next week with ETH Denver, and potential new narratives as restaking quickly emerging, the outlook for ETH in 2024 is looking increasingly bright.

Other Top Trends We're Watching

FalconX Trading Desk Color: The trends that have been in place at our trading desk have not changed much. BTC activity remains the highlight on the back of spot ETF flows, majors continue to dominate alts with activity in ETH picking up, and interest in alts is still heavily concentrated in relatively few select names. Prop desks, hedge funds, and retail aggregators tilted toward better sellers, while ETF issuers and venture funds were better buyers. The BTC/ETH volume ratio broke above 5x, with both major assets recording a buy/sell ratio above 1 for the first time in five weeks. Among alts, we saw roughly 50/50 flow on names like SOL, AVAX, and MATIC.

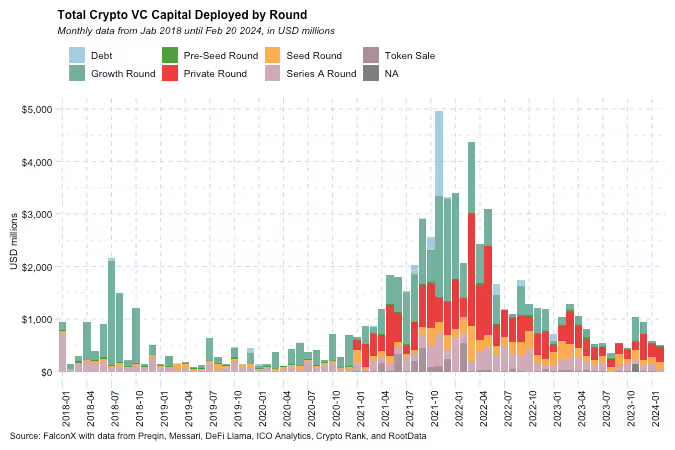

Crypto VC Capital Deployment Trailing the Previous Quarter So Far, but Recovery Trend Remains in Place: According to data aggregated by our market-making team, investment in crypto start-ups totaled $1.1 billion until Feb 20, 2023. Although the figure is trailing the $2.4 billion recorded in the previous quarter, it seems on track to beat the cycle low of $1.5 billion in Q3 2024. I continue to expect the recovery trend to remain throughout 2024, especially as we've been increasingly hearing from investors that private valuations are starting to look more attractive compared to public valuations.

So far in Q1 2024, we have not seen as many large deals as in the previous quarter, except for the $100 million a16z investment into EigenLayer and the $150 million raise by Beacon, the web3 accelerator launched by Polygon co-founder Sandeep Nailwal. Another notable trend was a market share increase in DeFi deals, with some early but prominent deals including Ethena, a yield-bearing stablecoin.

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.

.png)