Exploring the Relationship Between Risk-Free and ETH Staking Yields

A potential bull crypto market fueled by a more abundant liquidity environment and a perceived positive outcome for the industry in the 2024 elections would likely lead to ETH staking yields playing a more prominent role over the next few quarters.

Crypto continues to grind higher, with BTC breaking above the $65k mark for the first time since the end of July. After the Fed’s strong start of an interest-cut cycle last week, this week was marked by China’s whatever-it-takes-to-lift-markets surprising measures, which drove the great David Tepper to say on CNBC that he’s buying “everything” in the land of the Great Wall.

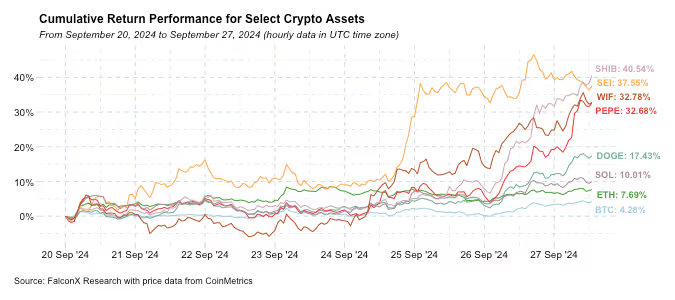

This latest leg of the upswing has been broader. BTC did well, but it was the third-lowest performer among crypto assets with a circulating market cap of over $10 billion. High-beta memecoins led the rally, as SHIB and DOGE scored the best performances among the larger names. WIF and PEPE were among the top three performers within assets with a circulating market cap of more than $1 billion. While SOL outperformed ETH again, the ETH/BTC ratio also slightly edged above the 0.04 level it traded below last week for the first time in over three years.

We have been discussing how, along with the upcoming election, this new leg of the macroeconomic cycle is one of the key driving factors of crypto price action. This is an appropriate time to explore the interplay between risk-free and staking rates, starting with ETH, a topic emerging among crypto institutional investors.

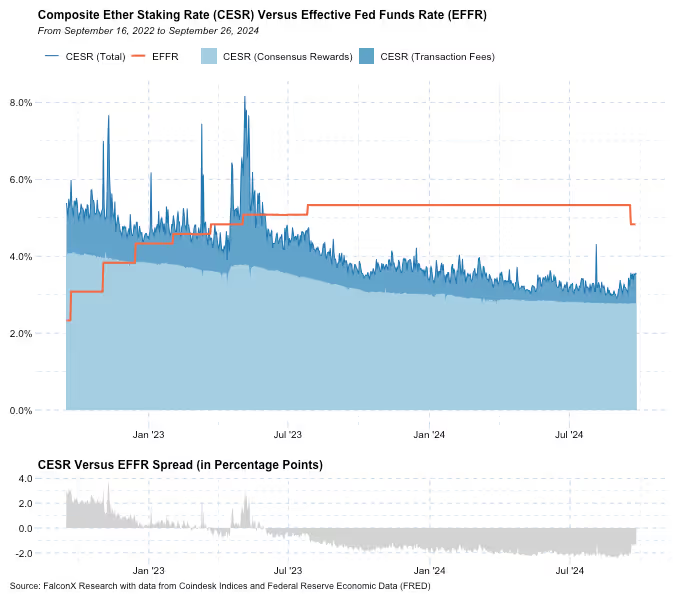

The chart below shows the excellently-built Composite Ether Staking Rate (CESR), broken down by its consensus rewards and transaction-fee components, versus the Effective Fed Funds Rate (EFFR) since Ethereum moved to proof-of-stake in September 2022. The second chart shows, just for reference, the spread between these two rates.

The spread between the Fed Funds Rate and the CESR has been negative since June 2023. However, the gap is narrowing and it now sits at the highest level since December 2023, except for August 5, the Japanese Yen unwind day that led to a brief spike in the CESR.

This spread will likely continue to shrink, and eventually turn positive, over the next couple of quarters due to a double-whammy effect.

First, the Fed Funds Rate is likely to keep going down.

The Summary of Economic Projections updated last week showed how Federal Reserve governors see the current level of interest rates as still highly restrictive: The longer-run estimates, a proxy for a neutral rate in the absence of shocks to the economy, currently range between 2.4% and 3.8%, well below the current 4.75%-5% range.

The CME Fed Funds Futures market is currently pricing 85% odds that the target federal funds rate will be below the 3.5%-3.75% range by March 19, 2025. It also priced 90% odds that the federal funds rate would be below 3.25%-3.5% by June 18, 2025. Although a lot can happen between now and then, this pricing would drive the CESR versus federal funds spread to neutral by Q1 2025 and put it in positive territory by Q2 2025, provided the CESR stays constant.

The second leg of the double-whammy effect is that the CESR has not been constant, and its most variable component is the portion of transaction fees collected by Ethereum validators.

Ethereum transaction fees have been on the rise recently and topped the highest level in over three months. However, they are still at only 10-20% of the levels seen in the previous bull market or even in March 2024 when crypto prices were breaking all-time highs.

Ethereum transaction fees have been trading down over the past three years due to the development of L2 technologies pushing transactions to cheaper clearing methods. However, higher blockchain activity can still have an impact on driving fees upward, as evidenced by the spike in 2024 almost one year after the Shapella upgrade.

This connection between transaction fees and the ETH staking yield makes the interplay between ETH staking yields and the ETH price somewhat unique compared to traditional finance yield-bearing assets.

Crypto bull markets tend to be associated with more intense blockchain activity, either because higher blockchain usage is fundamentally driving prices upward or because higher trading activity in itself also uses blockspace. At any rate, ETH staking yields tend to be more pro-cyclical compared to most traditional yield-bearing instruments.

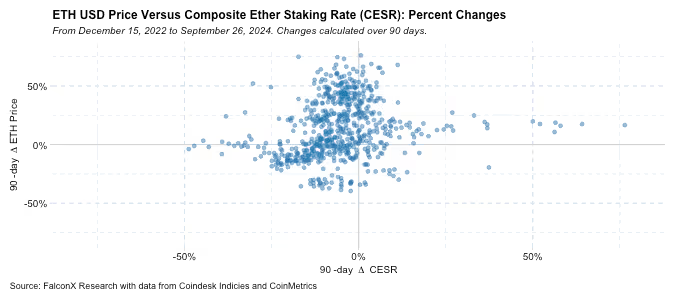

During bear, or even early bull markets, this trend is less clear. The scatterplot below shows the relationship between the 90-day percentage change in the CESR versus the Ethereum price. Although the CESR has been almost twice as likely to increase during periods of positive price appreciation compared to negative price appreciation, the overall correlation is lower than 0.2.

All in, a potential bull crypto market fueled by a more abundant liquidity environment and a perceived positive outcome for the industry in the 2024 elections would likely lead to ETH staking yields playing a more prominent role over the next few quarters.

We still have yet to see what juicy staking rates spread versus the risk-free rate amid a full-fledged crypto bull market for the price of ETH. The only time ETH staking rates were substantially above risk-free rates during a relatively long period was at the end of 2022, when the industry was grappling with the FTX debacle at the bottom of the previous bear market.

Improving staking yields dynamics are unlikely to be the main narrative driver to trigger an ETH price recovery. However, they can be a powerful supporting narrative by providing an additional reason to look further into ETH and helping further develop crypto interest rate markets as a critical DeFi primitive.

This is not a short-term trend, but one that could potentially develop over the next few quarters. Although the path of interest rates and the elections will become increasingly important throughout the rest of 2024, I’m interested in seeing whether such a potential trend could develop in 2025.

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.