Fed Loosens Up: Initial Thoughts on Crypto Cycles and Interest Rate Environments

The first interest rate cut of this cycle is now behind us. A favorable election outcome combined with a more favorable liquidity environment for risk assets could start the next crypto bull market.

Fed Loosens Up: Initial Thoughts on Crypto Cycles and Interest Rate Environments

Following an notable FOMC meeting due to the dramatic swing in expectations and the divided market expectations preceding the announcement, the first interest rate cut of this cycle is now behind us.

Perhaps even more relevant for risk assets, the statement language, the Summary of Economic Projections (SEP), and even Powell’s language during the press conference suggest that the inflation versus unemployment balance of risks is more even and interest rates remain in restrictive territory.

Further cuts appear to be the most likely path ahead, even if Powell made it very clear that this first 50 basis-point cut should not be understood as a new pace. CME Fed Funds Futures contracts are currently pricing 58% odds of a 25 basis-point cut in the next meeting just a couple of days after election day on November 7, and all the other 42% odds are attributed to another 50 basis-point Fed move.

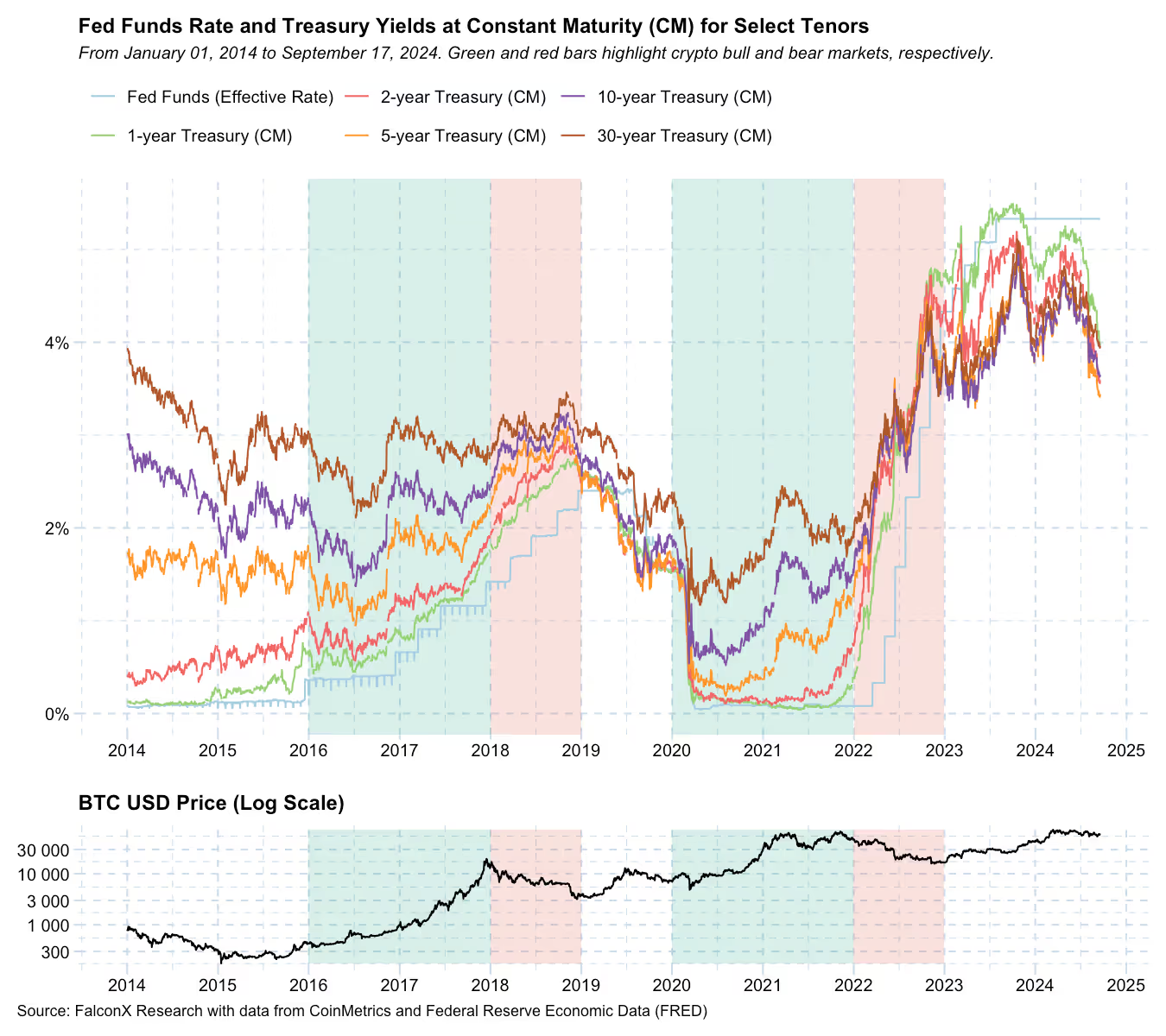

As the chart below shows, Treasury yields have anticipated this cut for a few months. For example, the 2-year constant-maturity Treasury yield dropped from a notch below 5.0% at the end of May to just about 3.5% the day before the meeting. This big anticipatory move could explain why yields actually edged up after yesterday’s announcement. Maybe some players just decided to take some profits off the table for now.

Risk assets, including crypto, took some time to absorb the dovish message. After climbing a bit right after the announcement, BTC dropped during and after the press conference to under $60k before resuming a somewhat steady climb toward the $63k level, its highest point since August 26.

Now that the rate-cutting cycle has started, the focus will quickly shift to what its magnitude and extent will look like. Economic activity will be the most pressing variable that will define the shape of this cycle. As Goldman Sachs analysts brilliantly showed, the performance of the S&P 500 index following rate cuts is highly dependent on whether a recession hits.

Even if the historic record of 50-basis-points is not favorable (the two instances this happened in the 2000s preceded the two major equity corrections of this century), the Fed has a lot going for it to averting a deep recession: This cooldown commences from a comparatively elevated interest rate baseline, household balance sheets appear relatively robust, and inflation generally seems to be trending in the right direction.

Unfortunately, crypto does not have a long enough price history to allow us to replicate the Goldman Sachs study for this emerging asset class.

Still, looking at crypto cycles in the context of interest rates could surface a few insights.

The chart below shows various interest rates (Effective Fed Funds and various Treasury constant-maturity yields from 1-year to 30-year tenors) since 2014, when crypto institutional investment started to emerge. For context, the BTC USD price is highlighted in the bottom chart in log scale for better visualization. The full-fledged crypto bull markets of 2016-2017 and 2020-2021 are highlighted in green, while the bear markets of 2018 and 2022 are highlighted in red.

The chart above indicates that a lower interest rate cycle combined with a soft landing, currently the base-case scenario for most investors, would be a novel macro environment for crypto.

While the 2016-2017 cycle was mainly endogenous and relied primarily on the industry, which was starting to spread beyond the early believers, the 2020-2021 cycle was triggered in large part by the exceptional interest rate cuts that followed the COVID crisis.

This likely means that macro will remain a critical price action for at least a few more months. Correlations between crypto prices and broad risk asset indices have been on the rise and are likely to remain elevated for a while.

The exciting side of this uncertainty is that the combination of a favorable election outcome and a more favorable liquidity environment for risk assets could start the next crypto bull market. The strong turnover of the past coupl of days and breadth of crypto returns suggest that the market is looking forward to what’s next.

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.