From Launch to Week One: Reflecting on the BTC Spot ETF Debut

The spot BTC ETF launch attracted significant attention and investment, with $3.3 billion in gross inflows and a net of around $1 billion after adjustments, marking it as one of the most successful launches in history. Moving forward, the market will watch how the large inflows from issuers like Blackrock and Fidelity balance against outflows from Grayscale, with expectations that ETF inflows will ultimately support long-term price stability.

The launch of and subsequent inflows into the spot BTC ETF has been driving attention, now not only in crypto circles but also in investing circles more broadly. After brushing the market of $1.75 trillion around the spot BTC ETF launch, the total crypto market cap ended the week at $1.59 trillion, or 4.7% lower over the past seven days. Among the larger names, ETH has been outperforming both BTC and SOL so far in 2024 (more on that below).

The gross inflows of spot BTC ETFs clocked in a whopping $3.3 billion in the first five days, with two issuers (Blackrock and Fidelity) breaking the$1 billion AUM mark.

The net number, however, excluding the $2.2 billion GBTC outflows, the less publicized $200 million BITO outflows, and other adjustments is closer to $1 billion. This is markedly in line with the bottom of the $1-2 billion range we estimated the market was pricing in the first week or two net inflows.

The massive first-day ETF trading volumes($4.6 billion) initially gave the impression that this expectation could be squarely beaten. But with the numbers for the first week in, we can safely put the spot BTC ETF launches as one of the most successful in history and simultaneously in line with the highly demanding market expectations.

But now the longer (and more interesting) game starts.

Currently, the two opposing major forces consist of the massive inflows that the larger issuers have brought in versus the GTBC outflows. Blackrock and Fidelity have been each gathering hundreds of millions of dollars daily, while the Grayscale outflows are in the $500 million per day range.

Both forces are likely to taper down over the upcoming months and quarters. The question is which will taper down first and, more importantly, which will dominate the price action in the long run.

The strong inflow trend may initially taper down faster than the GTBC outflow. After all, it is normal for ETF flows to recede from their launch levels and build sustainably from there. On the other hand, it’s only anyone’s guess when the Grayscale outflows will shrink, but it’s not showing any signs of it so far.

More importantly, however, I remain confident that the ETF inflows will ultimately dominate and prove an incredible supporting factor for prices. Unlike IPOs, which typically go through a weeks-long book-building process before listing, ETFs launch only with relatively small seed investments and gather assets afterward. Making the ETFs available on the larger platforms, talking to individual advisors, and supporting them to educate their end clients has just started and will likely last for quarters and years.

BTC has not been through a correction of over 15% since expectations started to build in mid-2023 and the ETF launch proved to be the perfect reason for a breather. The underlying positive trends, however, remain in place.

Other Top Trends We’re Watching

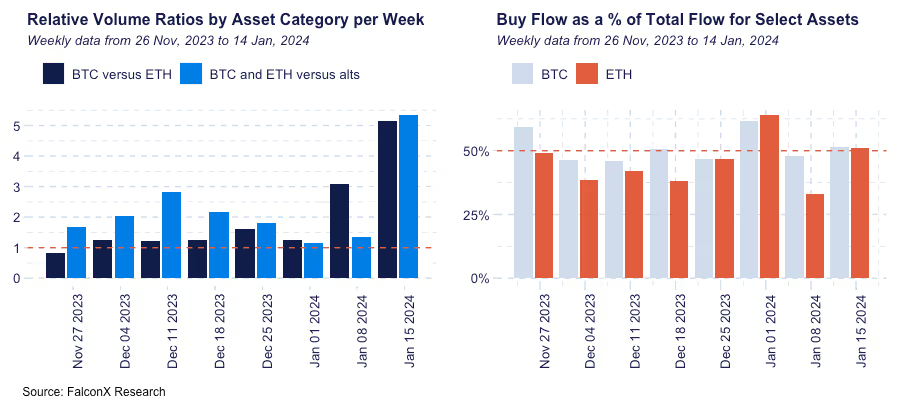

FalconX Trading Desk Color: As expected, BTC has led our desk activity following the spot ETF launch last week. BTC crossed our desks at more than 5x ETH’s volume, a ratio last surpassed only during the mid-2022 market turmoil. Most client personas, including ETF issuers, were better buyers, but hedge funds were more active on the sell side. Overall buy/sell ratios skewed above one for both BTC and ETH. Among alts, we saw buy interest in SOL and sell interest in Ethereum layer 2 projects such as ARB, OP, and MATIC.

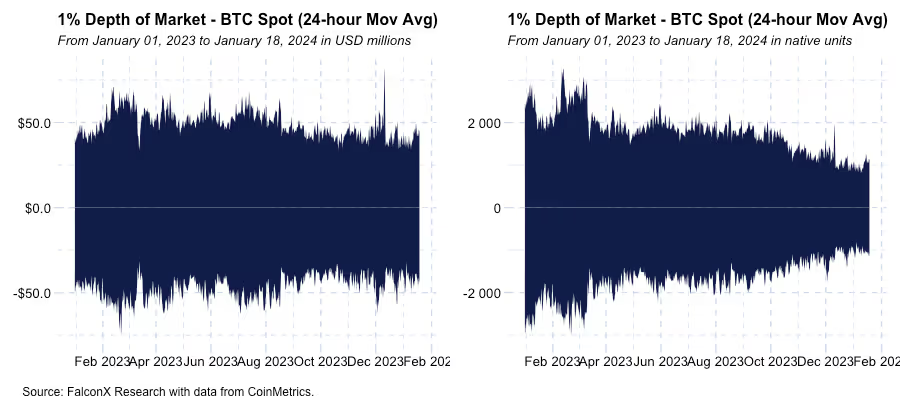

BTC Depth of Book Reverses Trend and Widens: The expectations around the ETF launch brought in more trading volume and investors more comfortable using leverage. This renewed interest was met with relatively tight order books, which, as we have been highlighting for a while, was a key factor supporting the strong price action we have seen since October.

This trend has been partially reversed following the launch of the spot BTC ETF. The BTC 1% book depth, previously hovering at or below 1,000 BTC, has experienced a notable 30-40% expansion post the ETF launch. The spike on the right end of the chart illustrates how the depth of the book, while still significantly lower than it was until October, has shown a gradual increase from the levels observed until the ETF launch.

It is too early to call a trend reversal, as we have seen the BTC orderbook widening in the past few months just to resume the tightening trend. But I’m paying attention to how the BTC orderbook dynamics shake out.

ETH/BTC Price Ratio Quickly Bounces Back to 0.06: One of the main topics of conversations with investors over the last few months was when ETH would stop underperforming BTC. After the ETH/BTC ratio broke below 0.05, the lowest level since May 2021, it quickly recovered.

Even if the recovery was not surprising (we and others have been calling for it once the BTC

spot ETF frenzy abates), the speed of the recovery was. Two more obvious price drivers were the shift of focus to the ongoing spot ETH ETF applications, which could be approved by May, and the upcoming Dencun upgrade, which will improve Ethereum’s scalability.

Less commented, though, are emerging expectations around a second Ethereum upgrade activating later in 2024 and the potential for new narratives (and buzz!) that can come from the 1H24 Ethereum conference circuit that starts with ETH Denver next month and goes all the way to ETH.cc in early July.

All in all, these catalysts can keep pushing the ETH/BTC ratio higher in the medium term.

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.

.png)