Investigating Crypto Market Sentiment As We Approach Election Day

With less than three weeks until election day, we expect the market's focus on this critical market event to increase further from here on. Implied volatility heavily clustered around November 5 but somewhat muted before and after election day is an interesting set-up.

Crypto keeps climbing, propelled by a favorable environment for risk-on assets exemplified by the equity market's extending its rally, despite concerns over its breadth due to rising long-term bond yields.

This week's crypto rally, however, has been notably broad, especially among mid-cap tokens. While BTC and ETH ranked in the top three performers for assets with over $10 billion market cap, names like ENA, WDL, and TIA surged by more than 20%. Conversely, UNI was the weakest among assets exceeding $1 billion market cap, likely due to profit-taking following its exceptional performance last week on the back of the announcement of their DeFi-focused L2 Unichain.

As we have been writing for a while, the two dominant trends that should continue to shape the market over the upcoming weeks and months should be the upcoming U.S. elections and the global macroeconomic environment.

We have also highlighted how this election cycle marks a turning point for the crypto industry. For the first time, crypto has become a mainstream political issue, engaging a broader audience. Additionally, Polymarket, a breakthrough application, now offers real-time insights into the relationship between crypto prices and election odds.

Another unique aspect of this election cycle is that, for the first time, we also have a robust options market that can provide insights into what the market is pricing around and after election day on November 5.

The chart below shows that open interest in BTC options on Deribit, which accounts for over 80% of the total crypto options activity, has more than tripled over the past couple of years to $17.7 billion. For context, this current amount represents a whopping 52.7% of the total open interest in the BTC futures market (including both perpetual and dated contracts), versus 33.1% at the beginning of 2023. It’s a good reminder of the exceptional growth the crypto options market has enjoyed over the past few years.

Not surprisingly, most of this open interest is concentrated in the end-of-year (32.7% of the total) and end-of-month (22.4%) expiries. We can, however, see increasing activity around and shortly after election day. The contracts expiring on November 8th and November 29th already represent 10.5% and 8.3% of the total Deribit BTC options open interest, up from less than 5% six weeks ago.

Implied volatilities, however, show a more intriguing picture.

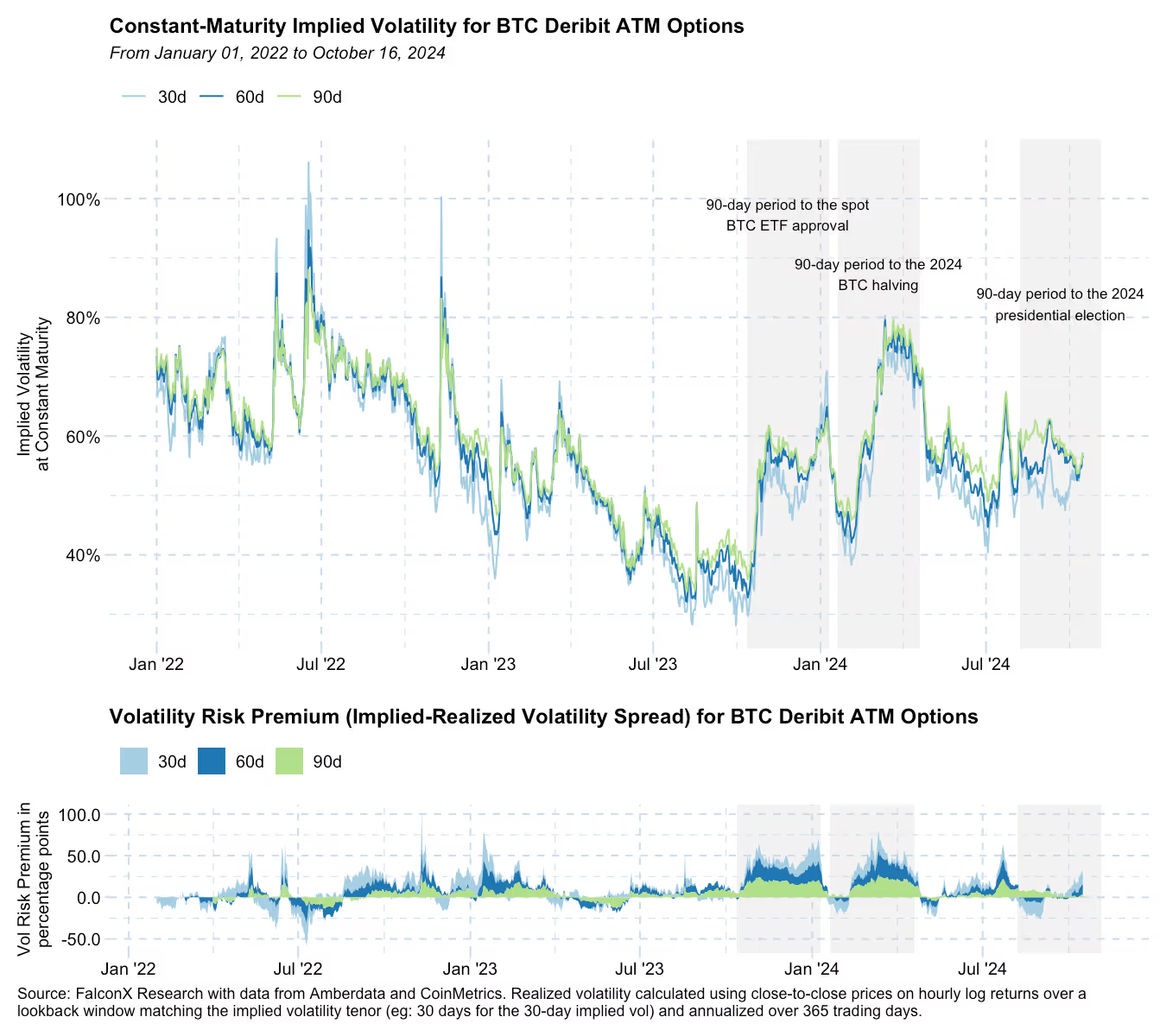

The chart below shows 30-day (light blue), 60-day (dark blue), and 90-day (green) implied volatility for Deribit BTC options on a constant maturity basis. The gray areas highlight three 90-day periods leading up to key dates the market built expectations for: The spot BTC ETF launch on January 10, the halving on April 19, and the U.S. elections on November 5. The bottom chart shows the volatility risk premium (i.e., the spread between implied and realized volatilities) for 30, 60, and 90 days.

The chart reveals a striking trend: implied volatilities typically have typically risen ahead of key events, as seen before the spot BTC ETF launch and the latest halving, where they increased by at least 25 points. However, the upcoming election breaks this pattern. So far, implied volatilities have remained stable or even decreased, contrasting sharply with previous events.

This trend is also evident relative to realized volatility. The second chart, displaying the spread between implied and realized volatilities, further illustrates this point. Currently, the volatility risk premium (the difference between implied and realized volatilities) is roughly half of what it was before the BTC ETF launch and halving.

However, it would be a mistake to immediately conclude that the market is expecting a smooth market around the election. If we look deeper into the individual expiries, forward implied volatility is heavily clustered around the election day and somewhat subdued leading to it and some time after it. Case in point, the forward volatility between November 1 and November 8 is at 73.1 points, implying a daily move of about 3.8% per day in that period.

This is more an issue of implied vols before and after the election being muted.

Finally, market positioning skews bullish. Investors are using the options market more as leverage to capture additional price action upside than to hedge any adverse potential scenario.

As the chart below shows, put/call ratios for BTC Deribit options have been below 1.0 on both a volume and open interest basis over the past couple of weeks. Although this is generally the case for all expiries between now and the end of the year, this is especially true for the contracts expiring at the end of the year and right after election day.

With less than three weeks until election day, we expect the market's focus on this critical market event to increase further from here on. Implied volatility heavily clustered around November 5 but somewhat muted before and after election day is an interesting set-up. Also, a top-side heavy positioning suggests investors are relatively more willing to use the options market to capture additional price upside.

However, these trends can quickly shift, and tracking them in real time could be crucial to gain further context on the next leg of the market price action.

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.

.png)