Low-Volume, Low-Volatility Market Remains; Drift Still Negative on Cloudy Macro Outlook

The crypto market slid slightly over the past seven days, as risk assets in general remain under pressure due to concerns with rising bond yields and a strong dollar. Over the past seven days, the total crypto market cap was down 1.6% (or 1.8% excluding stablecoins), and it currently stands at $1.02 trillion (or $898 million excluding stablecoins).

Volatility in majors remains low. The 30-day realized annualized volatility for BTC and ETH currently stands at 34.7% and 31.3%. These are rare because they represent relatively low levels, and ETH volatility is lower than BTC’s. In other words, while the current BTC volatility levels happened 12.6% of the time since 2016, we’re in the bottom 0.1% for ETH.

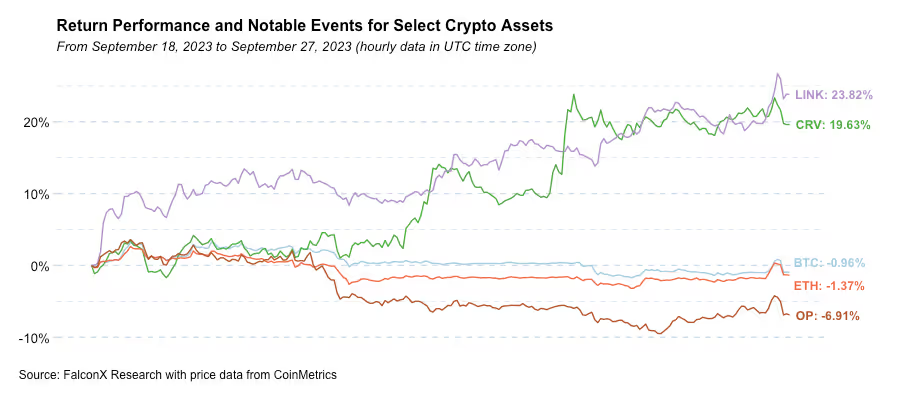

LINK was the best-performing asset among those with a market capitalization of more than $1 billion, as it continues to sustain momentum behind its interoperability and tokenization narrative. CRV is also up almost 20% as it partially recovers from a tough quarter marked by exploits and potential overhand issues. Finally, OP continues to correct from a strong performance until mid-August.

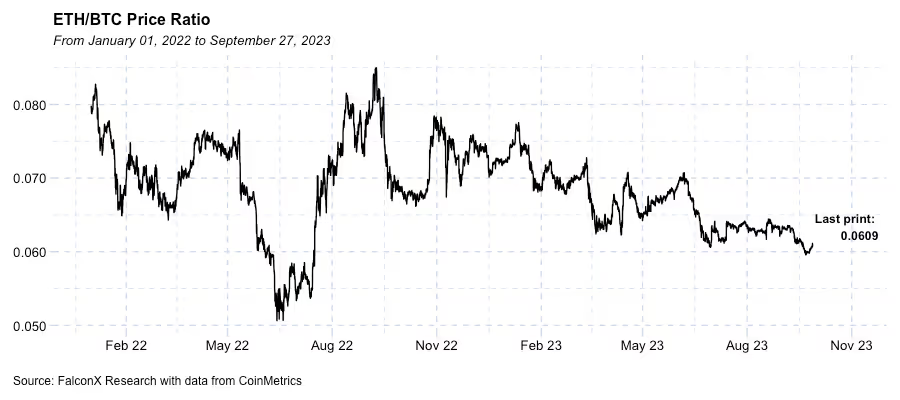

I'm closely watching the ETH/BTC ratio after it hit the lowest level in 2023.

Two catalysts that could shift this ratio higher between now and the end of the year are the likely approval of futures-based ETH ETFs in the next month and increasing interest in Dencun, the network's most significant upgrade since the Merge. The highlight of the upcoming upgrade will be the highly-awaited EIP-4844, which will boost scalability by significantly decreasing the cost of layer two solutions to post data on the Ethereum layer one.

On the other hand, the next major positive catalyst for BTC, which could drive the BTC/ETH ratio even lower, remains the potential approval of a spot BTC ETF. As expected, the SEC asked for more time regarding the Ark/21 Shares application, with the surprise factor being a relatively early response given that this response was due only on November 11. Overall, the chances of approval are still looking high (Bloomberg ETF analysts are giving it 75% odds but are signaling that they might trim it down a bit), but are more likely to materialize in either late 2023 or, more likely, ealry 2024.

Top Three Trends We're Watching

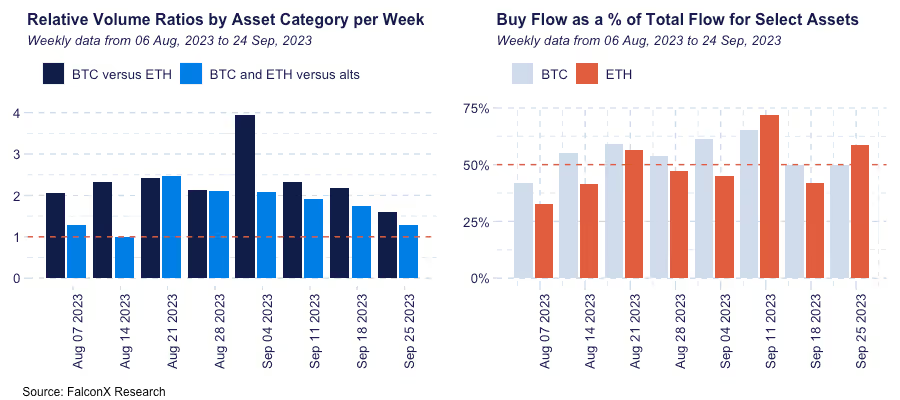

FalconX Trading Desk Color: Last week's flow tilted towards better buyers in majors, with a more pronounced bullish marginal interest in ETH versus BTC, and highly varied in alts across almost all investor personas. BTC still crossed our desk 1.6x more than ETH, but this week marked the fourth straight reduction in this ratio and the first time it has been lower than 2.0x over the past nine weeks. Our ETH flow also tilted more bullish, with 59% of our flow on the buy side compared to 50% for BTC, versus 42% and 50% in the previous week, respectively. Majors BTC and ETH traded 1.3x more than alts, the lowest value in the past seven weeks but concentrated in relatively few names. Buy/sell ratios varied considerably among alts: While we saw predominantly sell interest insome names (such as SOL and ADA), for others we saw mainly interest on the buy side (such as ARB and OP).

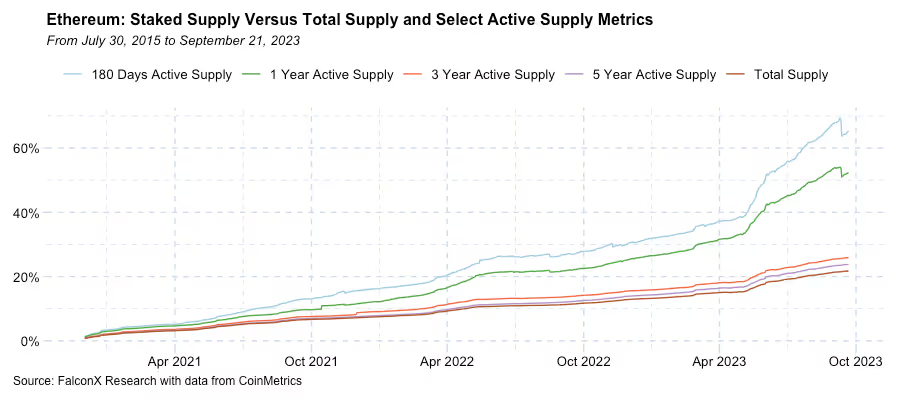

Ethereum Staking Adoption Skyrocketed Over the Last Year, But Could it Slow Down? The Merge upgrade, which effectively brought the Proof-of-Stake (PoS) mechanism to Ethereum, was activated almost a year ago. The subsequent Ethereum Shapella upgrade, which allowed staked ETH withdrawals is about six months old. These two monumental changes brought in the rise of the Ethereum staking industry in 2023.

By any conceivable metric, the Ethereum PoS transition was a tremendous success. According to data from Staking Rewards, the total amount of staked ETH currently stands at $41.5 billion, representing 46% of the total staked assets across all blockchains. Staked ETH already represents 21.7% of the total supply, versus 6.5% and 15.1% when the Merge and Shapella were activated, respectively.

When measured against other supply metrics, the adoption is even more striking: The supply of ETH staked has recently surpassed 50% and 65% of the supply active over the past year and six months, respectively.

But it’s not all rosy skies. Early signals indicate that the Ethereum staking adoption fervor could start to slow.

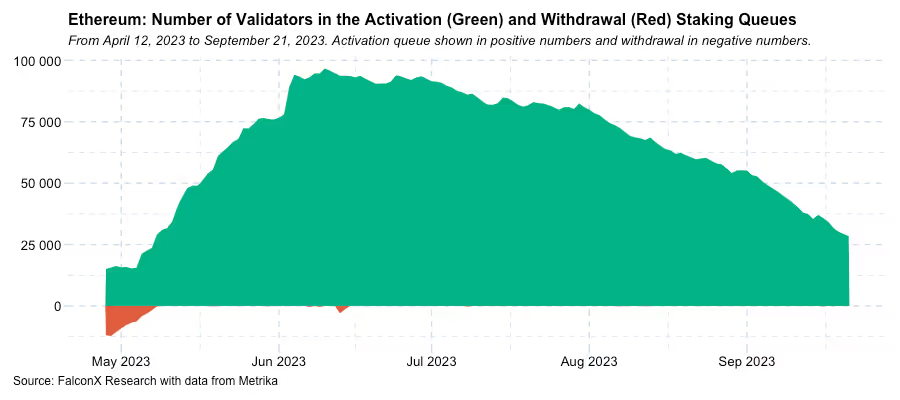

Consider the number of validators wanting to stake their ETH and waiting in line because the network can only handle a certain number of new entrants simultaneously. After the Shapella upgrade, this number grew to nearly 100,000 in less than two months. This far exceeds the number of people wanting to remove their staked ETH, which has been virtually zero for most of the time.

Since June 2023, the number of validators in the activation queue has consistently declined. It now stands at under 30,000, the lowest level since May. If this trend remains for a few months, the rate of increase of ETH staked will taper down in a couple of months.

One factor behind the slowdown is that broader macroeconomic conditions have shifted from a tailwind to a headwind for investors looking at crypto for yield generation. The Composite Ether Staking Rate shrunk from 5.5% at the Merge upgrade to 3.9% due to more validators and lower network activity.

For more details, read our piece on Ethereum staking published on Coindesk.

Upcoming Options Quarterly Expiry Shows Diversity of Views, According to Our Options Desk: Volatility remains somewhat low in crypto, so the forthcoming quarterly expiry this Friday, September 29, could be especially interesting. Deribit open interest shows that most of the outstanding contracts are in the $27,000 level for BTC, split between calls (3,584 contracts) and puts (3,773 contracts), according to data from Amberdata.

This even split indicates that option traders don’t have a clear opinion about where the price will go in the short term. The negative estimated gamma positioning at 26k suggests that dealer hedging activity may accelerate price swings (or volatility) around the 26k strike. On the other hand, the positive estimated gamma positioning at 27k suggests that dealer hedging activity may dampen volatility around the 27k strike.

Our options desk saw an uptick in bearish positioning, especially across fast money and crypto-native investors.

Have a great week!

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.

.png)