Spot ETH ETFs Approved in a Stunning Turn of Events; What’s Next?

Our thoughts on the monumental week for crypto, which included the approval of spot ETH ETFs after a remarkable turn of events and a series of political wins, and what's next.

As we anticipated at the beginning of the month, ETH is proving to be the primary beneficiary of a more benign regulatory and policy environment for crypto in the US. The surprise was how fast that shift happened.

The approval of eight spot ETH ETFs capped a week marked by the House approving the FIT21 crypto market structure bill in a historic vote in the House with strong Democratic support and also a bill banning the Federal Reserve from issuing a CBDC. All this followed last week’s Senate vote to kill the SEC’s crypto accounting policy, which would make it difficult for financial institutions to custody crypto.

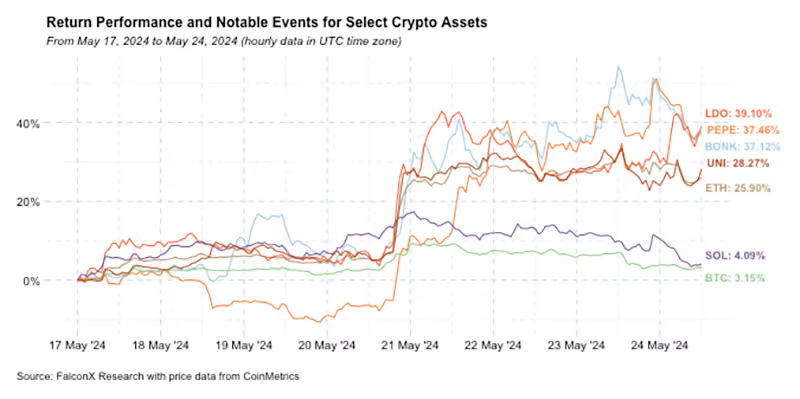

ETH was the only asset with a circulating market cap above $10 billion that returned double digits. SOL and BTC posted slight gains. Among alts, memecoins continue to do well, with PEPE and BONK as the best-performing assets with a circulating market cap above $1 billion and some ETH-related tokens, such as LDO and UNI, also posting robust gains.

With the main approvals out of the way, immediate attention now turns to two key issues.

Firstly, with the 19b-4 filings approved, the focus is on the SEC's greenlighting of the S-1s (or S-3s for Grayscale), which will clarify when trading can commence. Although there has been cases in which the gap between 19b-4 and S-1 was more than three months, I’m expecting that the spot ETH ETF processes will take significantly less, perhaps a few weeks or at most a couple of months. This is because this is not the first crypto ETF, and not even the first Ether ETF, that the SEC has approved at the S-1 level.

The second key question concerns initial inflows. My perception is that the overall market expectation is that ETH will attract something between 10% to 20% of the BTC inflows. For reference, at the recent Hong Kong simultaneous launch of spot BTC and ETH ETFs, ETH was able to attract about 20% of the BTC inflows. Perhaps the most important component on this side is whether we’ll see outflows from Grayscale’s ETHE trust, which now has an AUM of $11.1 billion.

Looking forward, the market is already speculating what is next for crypto ETFs. The perception of a friendlier regulatory stance lifts hopes among some that could see alt crypto ETFs relatively soon. It is important, however, to remember that BTC and ETH are the only assets that count with CME futures contracts. There’s a wedge between those and all other assets.

Although the FIT21 market structure bill could pave this way if it becomes law, for now it seems more likely that the next important crypto ETF milestones will be BTC and ETH blended ETFs, as mentioned above, and the potential introduction of options on some of the spot BTC ETFs. The deadline for the SEC to respond to the options applications is around September, and market attention should increase until then.

The recovery in ETH appears to be gaining traction as what was probably the most underowned asset in crypto is now back en vogue. Even with the recent outperformance, however, the ETH/BTC ratio has returned to its early March levels and remains significantly below its average over the past three years.

If the current crypto bull market follows the traditional pattern of BTC leading, followed by ETH, and then altcoins, the second phase with ETH has officially started this week.

Other Top Trends We're Watching

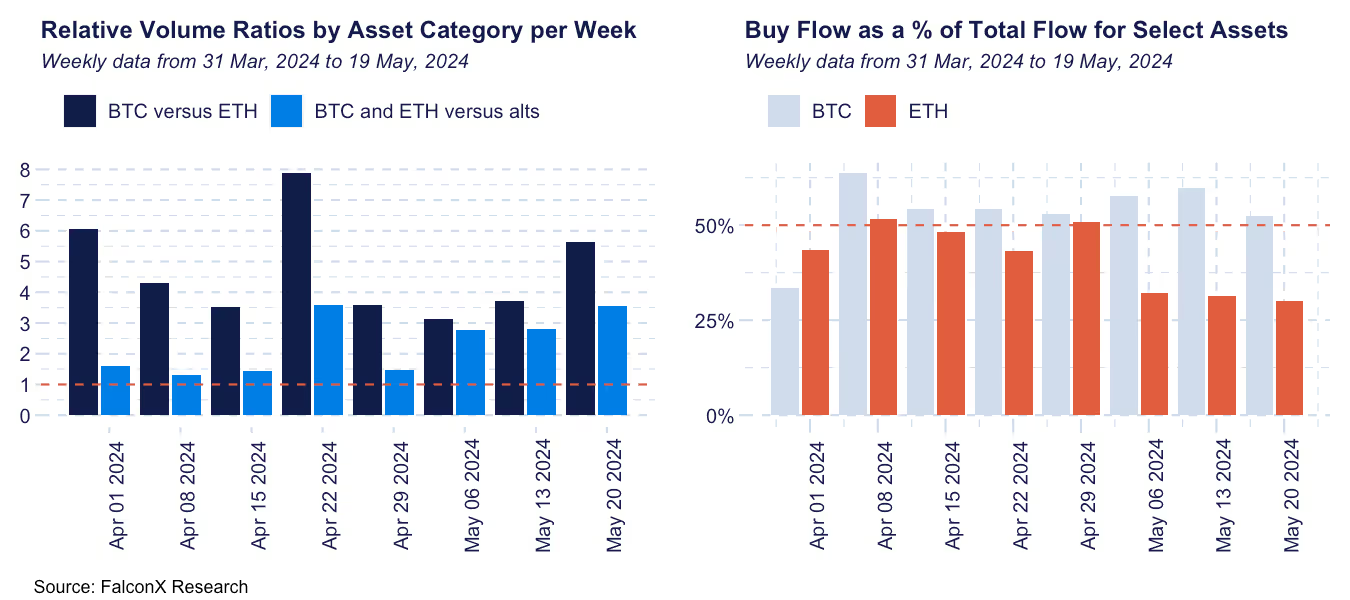

FalconX Trading Desk Color: The positive vibe shift made almost all client personas net buyers at the desk. Flow from prop desks and venture funds was particularly skewed to the buy side. ETH was the star of the show, as our BTC/ETH volume ratio dipped below 2x over the past few days for the first time since early March. Contrary to the past many weeks, in which 60-70% of our ETH flow was coming on the sell side, 75% came in as better buyers over the past few days. The increased interest in ETH and robust BTC activity drove our majors to alts volume ratio to more than 5x for the first time since mid-January. Within alts, we saw buy interest in SOL, ARB, DOGE, and SUI.

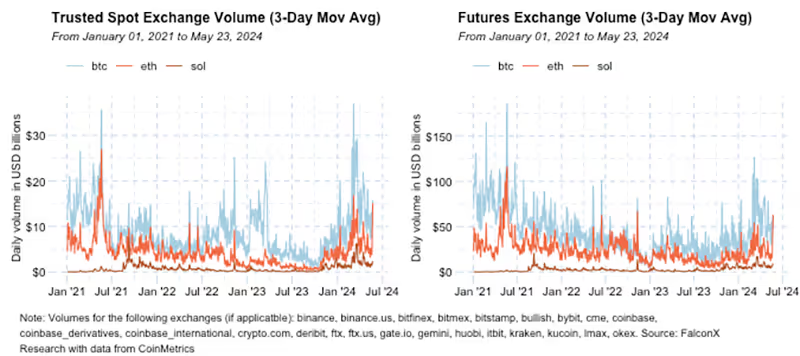

ETH Volumes Rise, Though General Market Volumes Stay Soft: The remarkable week for the second-largest crypto asset was mirrored in its trading activity. ETH's spot volumes hit $19.5 billion yesterday, marking the second-highest level in the last three years. Meanwhile, its futures volumes soared to $83.3 billion, exceeding BTC's futures volume for the first time.

Beyond ETH, spot volumes continue to lag. For May, BTC's spot and futures volumes are down 30.4% and 20.0%, respectively, from the March average. SOL has seen an even steeper decline, with spot and futures volumes dropping 49.3% and 33.7% over the same timeframe.

As we have emphasized for a while, volume activity has been a consistent confirming indicator of crypto price trends. I interpret the fact that liquidity trends have yet to respond significantly to recent shifts in crypto policy and regulation as good news since it suggests that the excitement remains confined mainly to specialist circles. Overall, a broad recovery in market volumes is one of the critical indicators I’ll be watching to gain confidence that we will sustainably break beyond the current price range.

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.

.png)