Unpacking BTC's Recent Price Surge and Estimating What the Market Is Priced In

Crypto remains on a tear. The total crypto market cap climbed 13.4% (15.0% excluding stablecoins) to reach $1.25 trillion ($1.12 trillion excluding stablecoins), brushing the highest level in 2023.

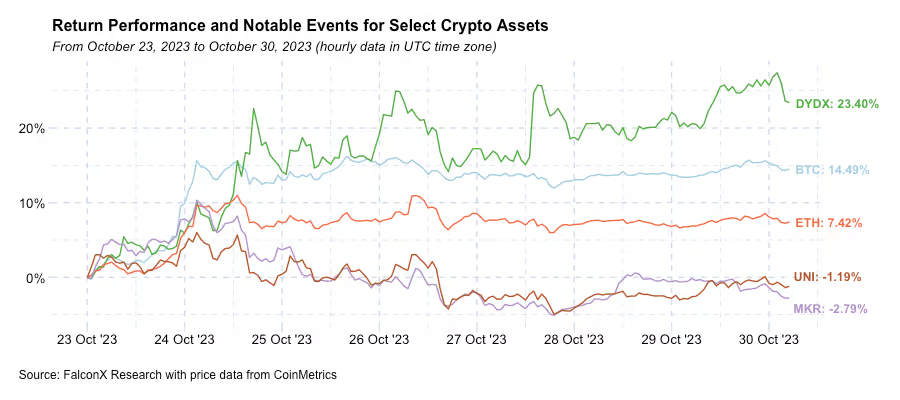

BTC was the star of the show as it traded around the $35,000 level for the first time since May 2022 on the back of increasing excitement about the likely upcoming spot ETF launch (more on that later). DYDX was up over 20% after it open-sourced its V4 code, marking the initiation of its much-expected transition from Ethereum to its own blockchain in Cosmos. On the other hand, MKR and UNI were some of the few assets that recorded a negative return last week. While the former was mostly correcting from a strong recent performance, the latter continues to be impacted by controversy around Uniswap Labs adding a 15-bps fee (not for the protocol itself, only at the front-end level) for certain key markets.

Last week started volatile with a false post on X/Twitter claiming that Blackrock’s spot ETF application was approved. It was quickly corrected, but only after over $100 million in short liquidations had been executed. Shortly after, however, news that the Blackrock ETF was listed in the DTCC ETFs list triggered some speculation that the ETF launch would be closed at hand. The ticker was later removed and then added back. Most of that drama was overblown, as it turns out that Blackrock’s ETF has been on the DTCC list since August. Although it’s fairly unusual to list the ticker and CUSIP this early, it does not say anything about how close the SEC is to approving the ETF application.

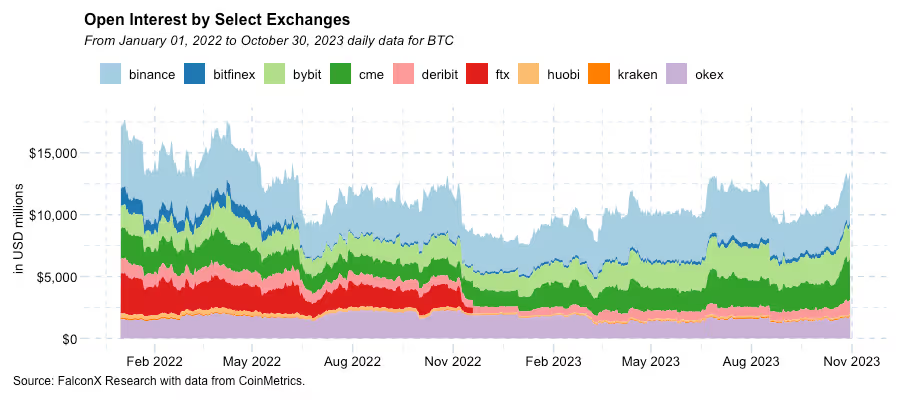

The market, however, took notice that the market was not fully pricing an ETF approval, and BTC was able to remain above the $34k level for most of the week. The strong rally was led by the futures market, which recorded the highest 1-day volume in the year. As the chart below shows, BTC futures open interest reached $13.4 billion, the highest level since June 2022. The strongest open interest increase was in the CME, which gained over 5 percentage points in market share over the past few days and is, for the first time, only 10% from topping Binance as the leading venue in terms of BTC open interest.

The relevant questions at the moment are: Is this rally sustainable? What is now priced in?

The market is now correctly fully expecting a spot BTC ETF approval either at the end of 2023 or the beginning of 2024. The key date to watch is January 10, 2024, which is the final deadline for the ARK/21 Shares application, the first of this batch. The recent SEC refusal to appeal the decision in their lawsuit against Grayscale, the flurry of filing amendments without structural changes to the initial fillings, and hints from the issuers that the SEC staff is constructively engaging on how to iron the current wrinkles reinforce this view.

The long-term impact of a spot ETF launch could bring to the asset class is clearly positive. First of all, it will open room for large pockets of capital that today can’t properly access crypto, such as financial advisors. One ETF issuer estimates that crypto US spot ETFs could attract as much as $55 billion in the first five years. Second, a seal of approval from the most prominent capital markets regulator in the world will bring an important seal of approval for this emerging asset class. Third, the upcoming approval of a BTC spot ETF will likely open room for discussions around a spot ETH ETF in 2024.

In the short term, however, the main question will likely be how much capital these ETFs will be able to attract. I believe that the first couple of weeks after launch will be critical to test how much appetite there is for crypto at the moment in these large pools of capital that are still relatively untapped. The fact that sub-optimal products such as BITO, the futures-based BTC ETF, and GBTC traded a whopping $2.5 billion over the last week indicates that a fair amount of capital sitting on the sidelines paying attention.

One (imperfect) way to measure how much the market is expecting to see in terms of short-term inflows is to compare potential net inflow scenarios to different assumptions about how the ask side of the BTC spot orderbook can look like.

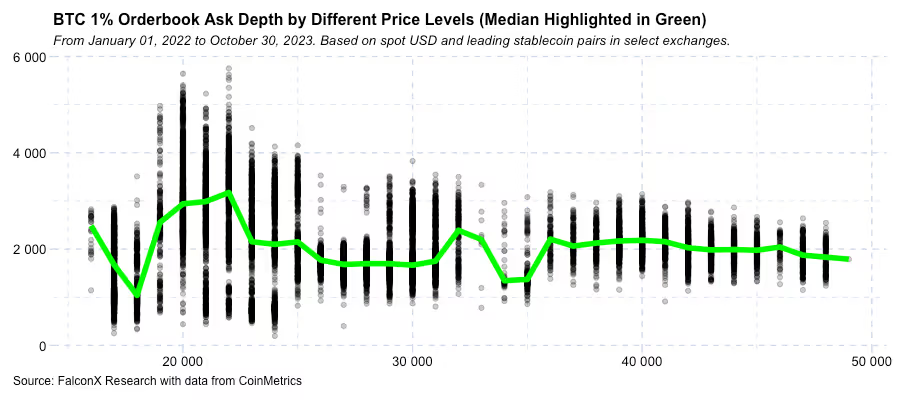

For historical context, the ask side of BTC’s orderbook in native units has been surprisingly stable over the past couple of years, especially for when prices trade above the $30k level. The chart below shows the ask orderbook on the y-axis for various BTC prices on the x-axis.

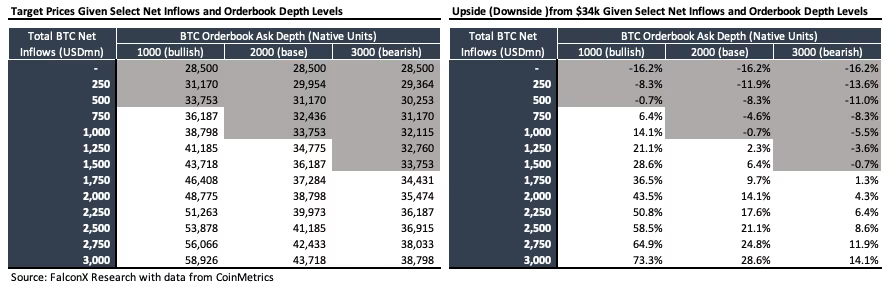

With that information, one can estimate how much net inflow would take to move the BTC price by a certain amount.

This analysis includes several assumptions, which I think lean toward the conservative side. One is that the move from the $28.5k price level to $34.0k was entirely attributed to the market anticipating price-insensitive net inflows from the ETF. The other is that the BTC price will move continuously across the order book, which might be the case as the price can gap up and the orderbook coalesce around the new higher price. Finally, this analysis does not assume any interference from the derivatives markets.

At any rate, we think it can give a conservative baseline for thinking about what the market is pricing if we assume a broad enough range of orderbook depth levels and focus on the shorter-term price impact.

The tables below show the BTC price impact, starting at the $28,500 level before this rally, with a certain amount of net inflow hitting the orderbook under different scenarios. The inflows are assumed to vary between zero and $3 billion. The 1% book depth in native units is assumed to vary from 1,000 (more positive for price impact) to 3,000 (less positive for price impact) versus the typical historical level of 2,000.

The overall message from this analysis is that the market is likely pricing initial (not necessarily day one, but over the first week or two) net inflows of between $500 million to $1.5 billion, depending on how tight the orderbook will be.

Based on this analysis, for BTC to establish a new range between the current $34k level and more than $40k, the total net inflows would need to amount to more than $1.5 billion. On the other hand, if total net inflows disappoint and come below $500 million, we could move back to the $30k level or even below.

This is the key variable I’ll watch up to and right after the spot BTC ETF launch. Given the caliber of the issuers lined up to launch, the favorable macroeconomic environment for alternative monetary assets, and the potential for more favorable liquidity conditions, I’m excited about the current crypto market prospects.

Other Top Trends We're Watching

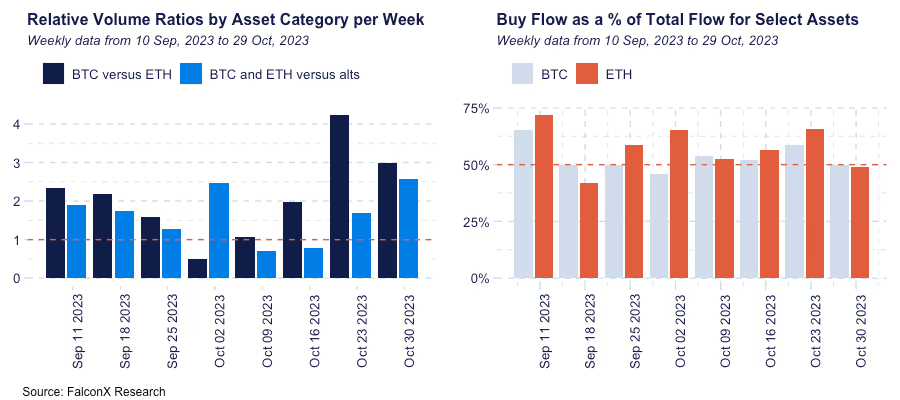

FalconX Trading Desk Color: BTC continues to dominate flows at our desk. BTC traded 3.0x more than ETH over the past week, lower than the 4.2x recorded in the previous week but still one the third-highest print for this ratio in 2023. Flow from certain investor personas turned more bearish over the past week (notably prop trading desks and retail aggregators). As a result, 50% and 49% of our BTC and ETH flow were on the buy side (versus 59% and 66% over the past week, respectively). With relatively few exceptions, interest in alts remains subdued. Majors BTC and ETH traded 2.6x more than alts, the highest level of the past four months, with most of the action tilted slightly toward the sell side.

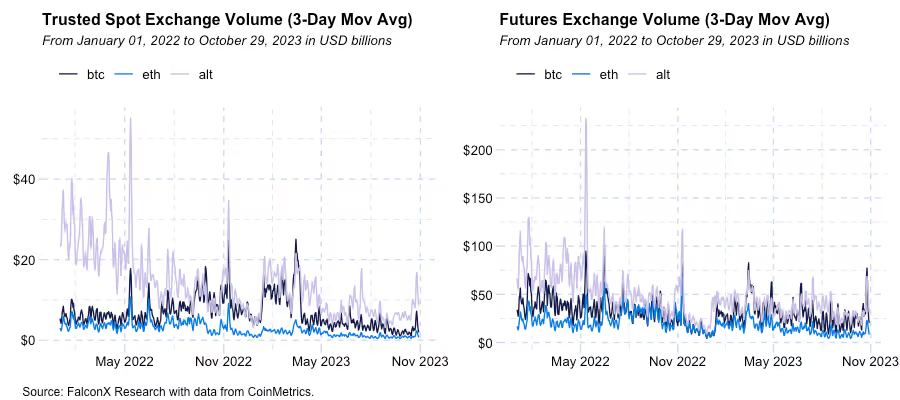

Market Activity Recovers Swiftly, Orderbooks Shrink: Contrary to most price upticks this year, strong volumes accompanied this rally. While activity was strong across the board, futures led the recovery: While the daily BTC futures volume recorded the highest level of the year, spot volumes printed just short of $10 billion, still the highest over the past six months. As the chart below shows, we also saw a strong recovery in the volumes of ETH and alts on both the spot and futures fronts.

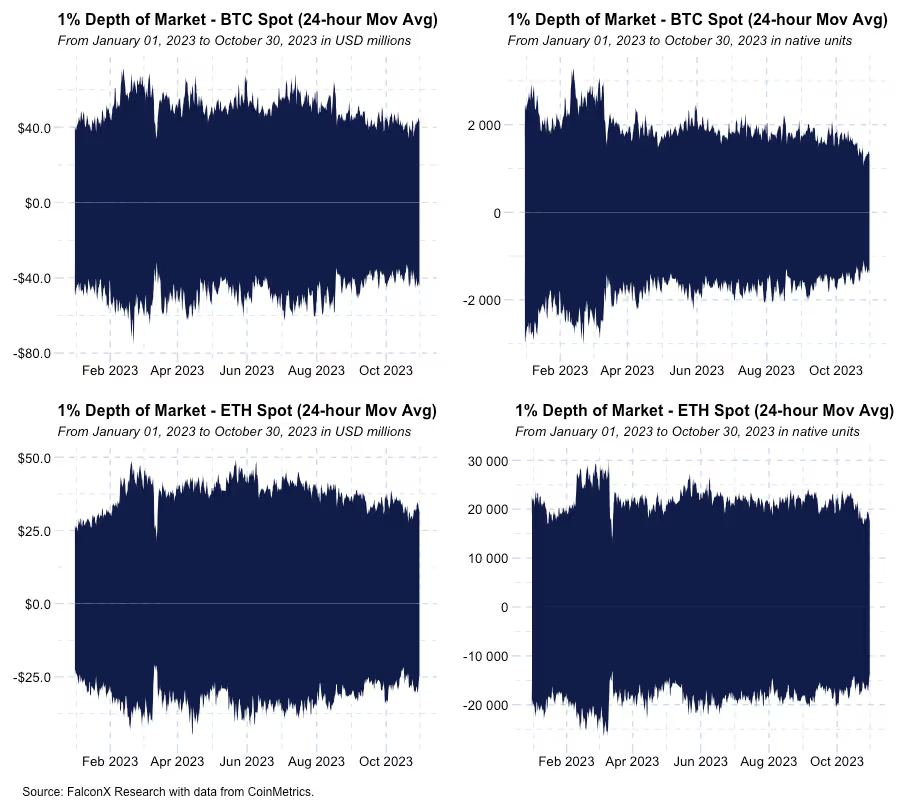

On the other hand, liquidity measured by order book depth has been shrinking for a few weeks. The chart below shows the 1% book depth for the main USD and fiat pairs for spot BTC and ETH (top and bottom, respectively) in both USD and native units (left and right, respectively). Interestingly, the ask side of the book shrunk more than the bid side to an extent that has not happened since January 2023. This is positive for prices as it highlights how much demand is overwhelming supply at the moment.

We’ve been highlighting for a while that strong liquidity trends would be an important confirming signal that the price recovery is sustainable. The early liquidity signs of this rally are encouraging, and I’ll be watching closely whether they remain in place.

Have a great week!

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.

.png)