Wall Street Welcomes Ethereum: Initial Reactions to ETH ETF Launch

In the first three days, spot ETH ETFs showed strong initial interest and trading volumes, despite significant outflows from ETHE. The launch of ETH ETFs is expected to boost ETH's performance and influence policy and regulatory shifts in the crypto industry over the medium to long term.

BTC continues to grind higher as momentum remains strong in the short term. The market, at least for now, remains confident that the Mt. Gox release could be absorbed relatively smoothly, and expectations build around Donald Trump’s keynote tomorrow at Bitcoin Nashville. In addition, medium-term catalysts, including a potential new administration more favorable to crypto, an interest-rate cutting cycle starting likely in September, and the still underrated potential approval of options on spot BTC ETFs in a few months, are also providing tailwinds.

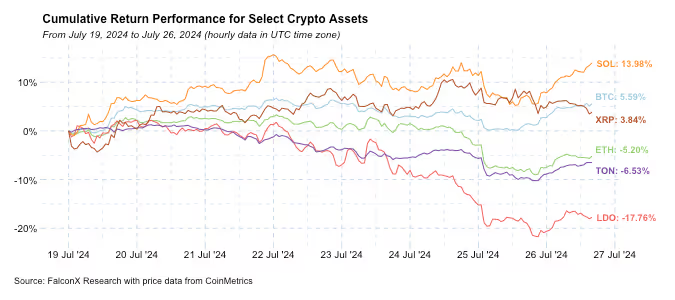

Beyond the largest crypto asset, the market was mixed over the past week. While SOL was up double digits and crossed the $100 billion mark in fully diluted market cap, ETH was down more than 5% due to heavy net outflows following its ETF launch on Tuesday (more on that below). Other notable laggards include Ethereum-related LDO and recently strong performer TON.

With the spot ETH ETFs already three-days in, we can already draw a few initial observations.

Gross inflows were robust, reaching almost $1 billion in only three days. Even if we assume that the Pantera interest to invest $100 million in the Bitwise ETF disclosed in their S1 materialized and exclude it from the flows number, gross inflows from the new issuers totalled a hefty $878 million, including inflows into Grayscale’s ETH mini trust of $119 million.

These figures are strong compared to the gross inflow figures we saw on the spot BTC ETFs both in the three days after launch ($2.0 billion) and over the past three days ($213 million) Remember that most expectations were around ETH ETF flows representing 15-25% of BTC’s.

On the flip side, ETHE outflows also came in heavier than expected at $1.2 billion for the first three days. For context, this is almost the same outflow that we saw for GBTC in its first three days of trading as an ETF.

It is possible, or maybe even likely, that the ETHE outflows will be more front-loaded than GBTC’s. GBTC had an impressive streak of 28 days with daily outflows of more than $50 million and 78 consecutive days of outflows. This is the key trend that will likely be front and center within ETH ETFs over the next couple of weeks.

ETF volumes, at $3.1 billion for the first three days, also signaled a strong start for ETH ETFs. This is 55% of the $5.6 billion that the spot BTC ETFs traded on their first day, more or less the same volume ratio in crypto spot markets as we highlighted a month ago.

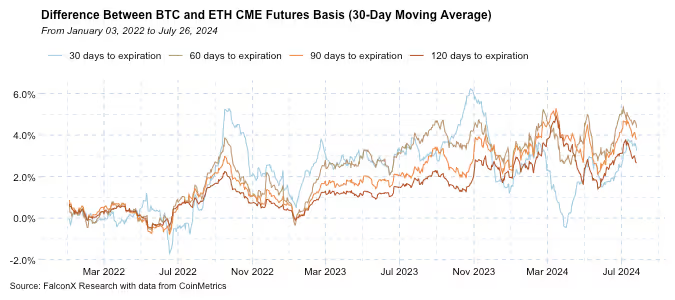

The volume comparison is especially interesting because it is likely that the CME futures versus ETF basis trade that has been boosting BTC ETF volumes is less attractive on ETH.

The chart below shows the difference between BTC and ETH CME futures basis for different tenors (constant maturity). The key trend, which we have highlighted before, is that the ETH basis is lower than the BTC basis by roughly the ETH staking yield.

Given that spot ETH ETFs don’t embed the staking yield at least for now, the CME futures vs. ETF basis trade is slightly less profitable than in BTC. This will likely be an active trade, but most likely to a lesser extent than it is for BTC.

That said, it's crucial not to underestimate the impact of the ETH ETF spot launch over the medium to long term.

For ETH itself, this recognition of its commodity status and the exploration of crypto use cases beyond digital gold among mainstream investors could significantly boost its performance over the coming quarters. Additionally, for the broader industry, the policy and regulatory shifts surrounding this approval represent a tailwind that still seems underappreciated outside of crypto specialist circles.

Other Trends We're Watching

FalconX Trading Desk Color: Our desk flow has been mixed, as prop desks and venture funds were more active on the sell side, while hedge funds and retail aggregators were more active on the buy side. However, over the past few days, our flow switched to the buy side across almost all investor personas during the correction. Although BTC continues to dominate our desk flows, the BTC/ETH volume ratio has shrunk to 1.5x around the spot ETH ETF launch, the lowest level over the past four months. The percentage of our ETH flow coming from the buy side has been hovering around 50%, but the same ratio for BTC grew past over 70% in some days. Alts activity was mainly on the sell side, and some of the most active names include SOL, UNI, HNT, AVAX, ADA, and ARB.

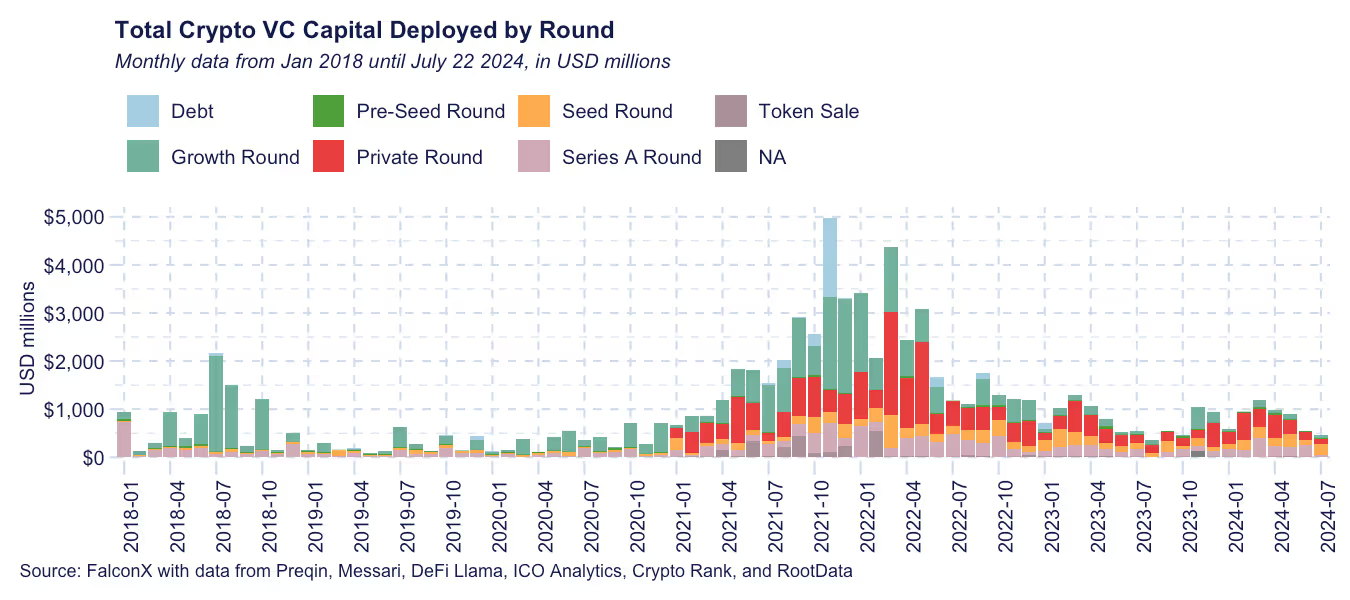

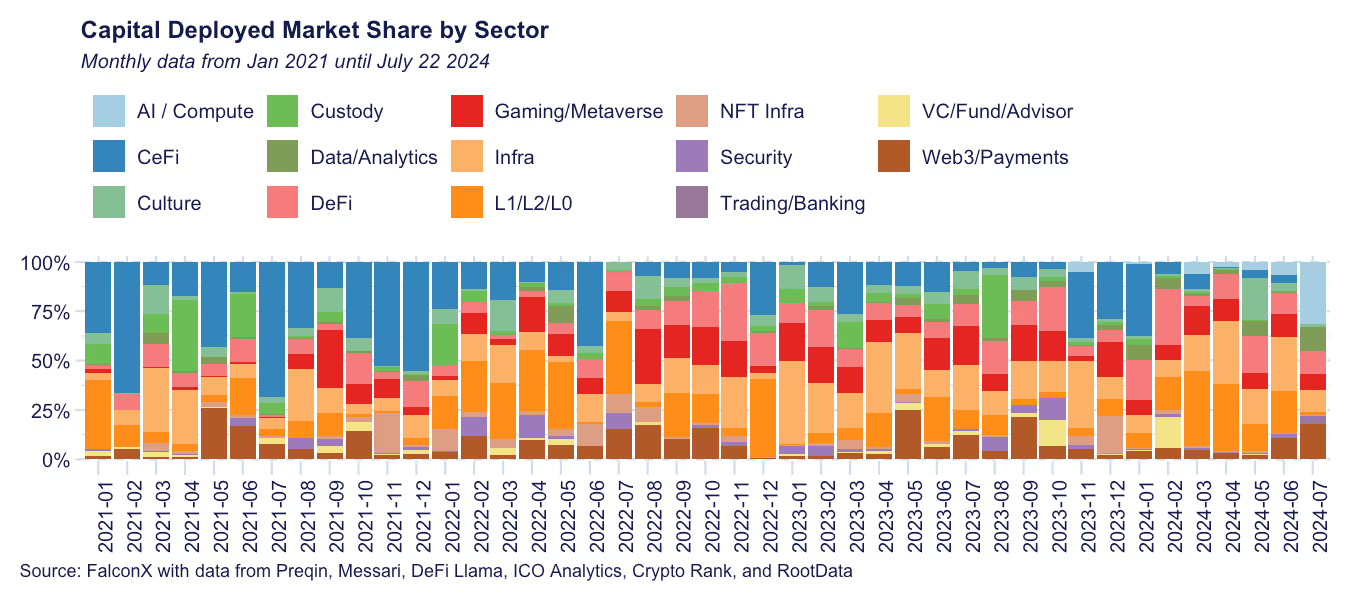

Crypto VCs Slowing Down Deal-Making Activity During U.S. Summer: According to data gathered by our market-making team as of July 22, total capital crypto venture capital deployment this month stood at $454 million. If this trend remains, it could confirm the downtrend in capital raised by crypto VCs we started to see at the end of Q2. For context, March, April, May, and June saw $1,191 million, $990 million, $900 million, and $545 million in deals.

Two noteworthy verticals this month were AI/Compute, led by Sentient’s $85 million seed raise led by Founder’s Fund, and Web3/Payments, with blockchain payment network Partior’s $60 million series B raise led by XV Partners with participation from the likes of Jump Trading. These two deals alone accounted for almost a third of the total capital raised in July.

Crypto venture capital deal volume bottomed out in Q3 2023 at $1.4 billion but then recovered to between $2 billion and $3 billion in each of the following three quarters. Unlike other sectors, crypto venture activity during the summer tends to align more with the market cycle than with summer seasonality. Over the past six years, deal volume in the third quarter increased compared to the previous quarter three times and decreased three times.

The potential short-term pause does not change the long-term outlook for crypto startup investments. Deal-making activity is expected to increase over the next 6-18 months due to the recent closing of fresh new funds and multiple ongoing fundraising efforts.

This material is for informational purposes only and is only intended for sophisticated or institutional investors. Neither FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., FalconX Foxtrot Pte Ltd., FalconX Golf Pte Ltd., Solios, Inc., Falcon Labs, Ltd., KestrelX, Ltd., nor Banzai Pipeline Limited (separately and collectively “FalconX”) service retail counterparties, and the information on this website is NOT intended for retail investors. The material published on this website is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of FalconX or any of its affiliates. Any information contained in this website is not and should not be regarded as investment research, debt research, or derivatives research for the purposes of the rules of the CFTC or any other relevant regulatory body.

Prior to entering into any proposed transaction, recipients should determine, in consultation with their own investment, legal, tax, regulatory, and accounting advisors, the economic risks and merits, as well as the legal, tax, regulatory and accounting characteristics and consequences of the transaction. Pursuant to the Dodd-Frank Act, over-the-counter derivatives are only permitted to be traded by "eligible contract participants" (“ECP”s) as defined under Section 1a(18) of the CEA (7 U.S.C. § 1a(18)). Do not consider derivatives or structured products unless you are an ECP and fully understand and are willing to assume the risks.

Solios, Inc. and FalconX Delta, Inc. are registered as federal money services businesses with FinCEN. FalconX Bravo, Inc. is registered with the U.S. Commodities Futures Trading Commission (CFTC) as a swap dealer and a member of the National Futures Association. FalconX Limited, FalconX Bravo, Inc., FalconX Delta, Inc., Falcon Labs Ltd., and Solios, Inc. are not registered with the Securities & Exchange Commission or the Financial Industry Regulatory Authority. FalconX Golf Pte. Ltd. is not required to be registered or licensed by the Monetary Authority of Singapore (MAS). MAS has granted FalconX Foxtrot Pte. Ltd. a temporary exemption from holding a license under the PSA for the payment services caught under the expanded scope of regulated activities for a specified period. FalconX Limited is a registered Class 3 VFA service provider with the Malta Financial Services Authority under the Virtual Financial Assets Act of 2018. FalconX Limited is licensed to provide the following services to Experienced Investors, Execution of orders on behalf of other persons, Custodian or Nominee Services, and Dealing on own account. FalconX’s complaint policy can be accessed by sending a request to complaints@falconx.io

"FalconX" is a marketing name for FalconX Limited and its affiliates. Availability of products and services is subject to jurisdictional limitations and capabilities of each FalconX entity. For information about which legal entities offer trading products and services, or if you are considering entering into a derivatives transaction, please reach out to your Sales or Trading representative.

.png)